Transparency Reporting Made Simple: Insights on the Sunshine Act

Table of Contents

- The Journey of the Sunshine Act

- Key Concepts of Sunshine Act Compliance

- Sunshine Act Reporting Requirements: What Must Be Reported?

- The Reporting Process and Timelines

- Detailed Sunshine Act Reporting Steps

- US States with Similar Reporting Requirements to the Sunshine Act

- Overcoming Challenges in Sunshine Act Compliance

- The Value of Compliance

- Conclusion

The Journey of the Sunshine Act

Before delving into the intricacies of Sunshine Act compliance, it’s vital to understand its origins and significance.

The Physician Payments Sunshine Act, commonly referred to as the Sunshine Act, was signed into law by President Barack Obama on March 23, 2010, as part of the Affordable Care Act (ACA). Championed by Senators Charles Grassley (R-IA) and Herb Kohl (D-WI), its primary goal was to enhance transparency in the life sciences sector by exposing financial relationships between drug manufacturers, medical devices, and healthcare professionals or institutions.

The act addressed growing concerns about how such relationships might influence medical decisions and healthcare costs. By mandating public disclosure, the Sunshine Act fosters ethical practices and allows stakeholders to assess whether these relationships impact patient care.

After the ACA’s passage, the Centers for Medicare & Medicaid Services (CMS) spent two years developing the framework for implementation. Data collection began in 2013, with the first disclosures published on the Open Payments database in September 2014.

This legislation marked a pivotal shift in global transparency reporting, setting the standard for ethical conduct in the healthcare and MedTech industries.

The CMS advanced the ACA’s mandate by launching the Open Payments Program. While the Sunshine Act’s reporting requirements initially posed challenges, CMS introduced the Open Payments rule in 2011, finalized in February 2013. Data capture began on August 1, 2013, with March 31, 2014, set as the first reporting deadline—a date that remains the annual submission deadline for life sciences companies.

Key Concepts of Sunshine Act Compliance

Understanding the key entities subject to Sunshine Reporting is fundamental:

- Applicable Manufacturers: Companies involved in producing or distributing drugs, devices, or biological products covered under Medicare, Medicaid, or Children’s Health Insurance Program CHIP.

- Applicable GPOs: Group purchasing organizations that negotiate the purchase of covered medical products.

- Covered Recipients: Includes physicians (excluding residents) and teaching hospitals.

Sunshine Act Reporting Requirements: What Must Be Reported?

The Sunshine Act requires disclosure of any “transfer of value” (direct or indirect) to covered recipients, including:

- Consulting fees, gifts, meals, travel, honoraria, research funding, education, grants, royalties, license fees, and more.

- Ownership or investment interests held by physicians or their immediate family members.

However, exemptions exist, such as product samples intended for patient use. Non-compliance can result in penalties and heavy fines for deliberate failures to report.

The Reporting Process and Timelines

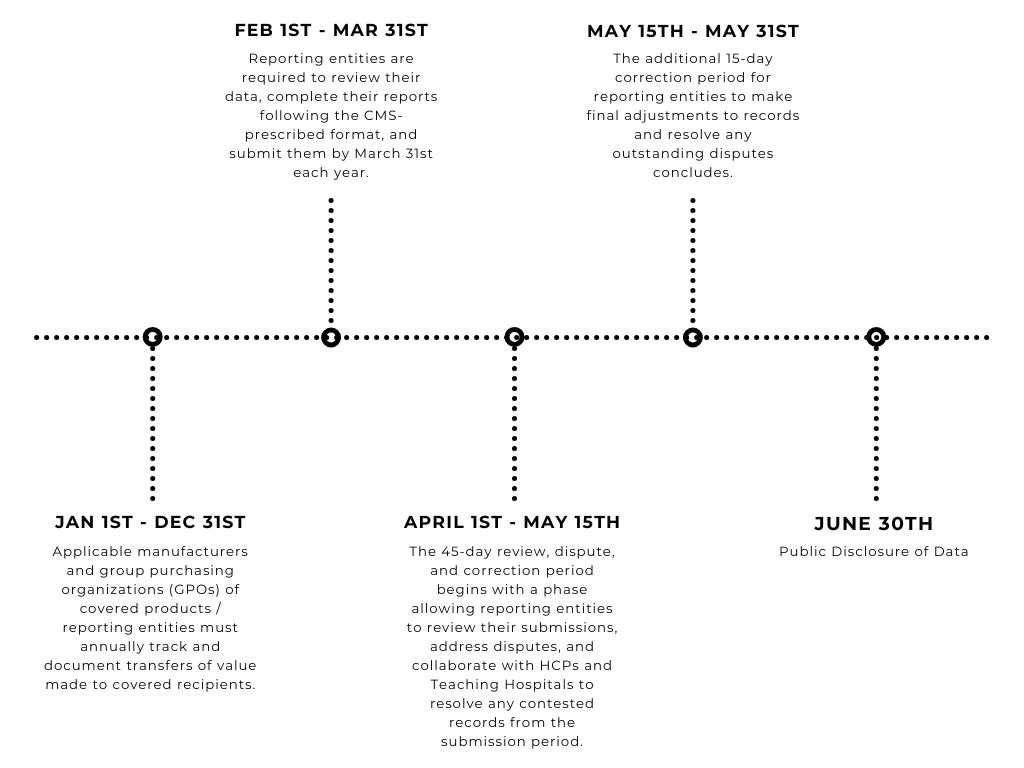

CMS Open Payements Timeline

Life sciences companies, including applicable manufacturers and GPOs, are required to collect and track payment, ownership, and investment data year-round.

To streamline this process, CMS provides an annual reporting template to ensure data is collected in a compatible format. Data submission typically starts on February 1 and concludes on March 31 of the following year.

After submission, CMS reviews, verifies, and prepares the data for publication. A 45-day review period in the summer allows physicians and teaching hospitals to review and dispute any discrepancies before the data is published on the CMS website.

Detailed Sunshine Act Reporting Steps

The Sunshine Act obligates life sciences companies to report any “transfer of value” to the Centers for Medicare & Medicaid Services (CMS). This includes transfers related to drugs, medical devices, biologics, and other products requiring FDA approval (premarket approval, or premarket notification) or a prescription.

Key organizations required to report include:

- Drug, biotechnology, and medical device companies

- Group purchasing organizations (GPOs)

- Products covered by Medicare, Medicaid, or the Children’s Health Insurance Program (CHIP)

- Distributors of medical devices, owned by physicians

- Transfer of values or payments made to covered healthcare professionals such as physicians, dentists, podiatrists, optometrists, chiropractors, and teaching hospitals

The Sunshine Act categorizes disclosures into three types:

- General Payments: Includes items like meals, travel, or non-research-related payments (TOVs).

- Research Payments: Relates to funds (TOVs) given for clinical trials or other formal research agreements or protocols.

- Ownership or Investment Interests: Ownership information or investment interests that physicians or their immediate families have with reporting entities.

Payments can fall into one of these groups:

- Direct Payments: Payments made directly to the covered recipients.

- Indirect Payments: Payments made through intermediaries to the covered recipients.

- Third-Party Payments: Payments allocated to third parties designated by the recipient.

Exempt from reporting are patient education materials and product samples.

Penalties for failing to report a transfer of value start at $10,000 per unreported payment, with more severe penalties for intentional violations.

In addition to federal requirements, several states have implemented their own transparency laws. For example, Vermont’s Prescribed Product Gift Ban and Disclosure law, which predates the Sunshine Act, includes more comprehensive regulations.

US States with Similar Reporting Requirements to the Sunshine Act

Some states listed below may mandate payment disclosure reports and recipient categories that go beyond the requirements at the federal level.

- Minnesota

- Nevada

- Massachusetts

- California

- West Virginia

- Washington D.C

- Connecticut

- Louisiana

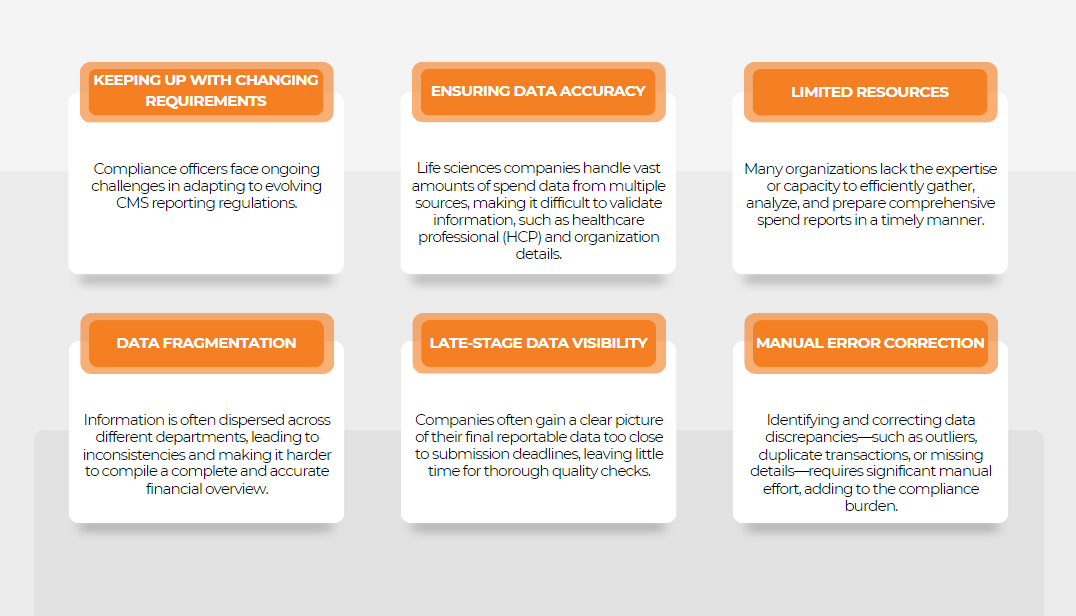

Challenges in Sunshine Act Compliance

- Understanding what falls under ‘Transfer of Value’.

- Ensuring accurate identification of covered recipients.

- Managing extensive data collection and reporting, especially for large organizations.

Implementing clear guidelines and procedures to accurately identify and monitor transfers of value as well as investing in compliance software and conducting regular training can help address these challenges.

The Value of Compliance

Beyond regulatory obligations, Sunshine Act compliance is an ethical imperative. It builds trust in the healthcare sector, mitigates conflicts of interest, and fosters improved patient care.

Non-compliance risks include hefty fines of up to $1.15 million (for knowing failures to report) and reputational damage, making a robust compliance program essential.

Conclusion

Compliance with the Sunshine Act is both a regulatory necessity and a commitment to transparency. By staying informed about reporting requirements and leveraging advanced tools, life sciences companies can lead the way in ethical practices and global transparency reporting.

Remember, compliance isn’t just about following rules—it’s about fostering trust, maintaining integrity, and contributing to a more transparent healthcare ecosystem.